What Rental Income can I Expect on Property in Phuket?

Rental Income on a property in Phuket

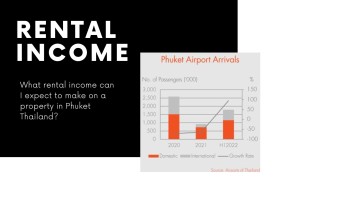

For property investors, it is important to estimate your average rental returns on property in Phuket Thailand. This article will focus more specifically on Phuket. The good news, Phuket is one of the most popular travel destinations in all of Southeast Asia. Only Bali Indonesia ranks higher in popularity.

Unlike many areas of Europe, where there is little to no rental activity during the low season, Phuket occupancy rates in the low season are respectable and above average when compared to other areas where you can purchase property in Thailand. That's due in part to strong domestic tourism from Australia and relatively fair weather conditions during the low season. While the rain can get heavy in October, there aren't any periods where tourism shuts down or stops completely.

The high season in Phuket Thailand is exceptional and runs from November through April and sees strong and robust annual rental income returns due to phenomenal weather. On top of this, people are escaping to Phuket to avoid the cold weather in their home country.

Basically, there are three ways to generate a profit from your property in Phuket Thailand. Rental income can play the biggest part. In this article, we will be focusing on rental income and rental returns from property in Thailand.

Phuket Rental Income Yield

Maximizing rental income requires some planning and fundamental decisions to be made prior to purchase. Location is always one of the key factors when choosing a rental property in Phuket Thailand. Phuket's west coast has been proven to provide strong rental returns for investors. The beaches on the west of Phuket are white sand with clear blue water great for swimming and relaxing. The west has some of the best nightlife on the island.

Property within walking distance of the beach will do very well in Phuket and are in high demand commanding a higher average nightly rate. Travelers looking for accommodations in Phuket are usually wanting to be close to the beach. Some properties further away will offer a shuttle bus to the beach giving owners and their guests more flexibility.

The most common ratio used for rental income is "rental income yield", which is the rental revenue received in one year divided by the purchase price. Rental yield is a way to compare and analyze properties in Phuket and properties in Thailand. If the property has been used as a rental, the seller will usually provide the rental history of what the property rents for high season and low season.

Developers of new construction will have rental estimates and figures ready for buyers. This is usually presented on a rental income spreadsheet. New developments will set up a rental management program for buyers. These days, investors are looking to rent out their property and make a profit.

When evaluating rental properties, think of their rental potential and rental packaging. What are the distinguishing features or attributes that are valued by the rental market? For example, "great location with sunset views from the rooftop pool ...five-minute walk to the beach ... private location ... close to restaurants, bars, and nightlife."

Alternatively, properties can be distinguished by architectural design, facilities, or being close to something like golf. Rental property in Thailand needs to distinguish itself in some way that is valued by the rental community. This is a great way to maintain higher occupancy levels and achieve higher average nightly rates.

Guaranteed Rental Return in Phuket Thailand

It is common now to see "guaranteed rental return" being offered for new condominium construction. These developers are offering anywhere between 5-8% guaranteed rental returns per year. The number of years and percent can vary from property to property in Phuket Thailand.

Many "guaranteed return" programs will offer the owner 1 month a year of usage in addition to this rental return. Make sure that the rental guarantee is in your contract and get familiar with the restrictions on usage to make sure it's a good fit for you and your family.

For example:

Average Phuket Rental Income Return

Investors are averaging between 4-10% annually on Phuket rental property. Depending on their own personal usage and what they paid for the property of course. If an investor owns 2 properties, they can often get into double-digit returns. Rental bookings can overlap during the high season and owning 2 similar properties can help handle all the bookings.

Phuket Thailand has many professional management companies to manage your property. CBRE, Knight/Frank, and LLJ are all on the island and will professionally manage your rentals and property. Some owners will handle their own bookings and find responsible Thai staff or a housekeeper.

Airbnb is gaining in popularity managing property in Phuket Thailand and can be quite profitable. However, it is not fully legal to use Airbnb in Thailand at the moment but somehow it is still running. This should be ironed out within the next couple of years.

For more information about investing in rental income property in Phuket Thailand, call us today at +66 93 606 0906